Not known Incorrect Statements About Pvm Accounting

Not known Incorrect Statements About Pvm Accounting

Blog Article

The Best Guide To Pvm Accounting

Table of ContentsThe 45-Second Trick For Pvm AccountingNot known Facts About Pvm AccountingIndicators on Pvm Accounting You Should KnowThe Greatest Guide To Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking AboutThings about Pvm Accounting

Supervise and take care of the development and approval of all project-related invoicings to consumers to foster good interaction and avoid issues. financial reports. Guarantee that proper records and documentation are submitted to and are upgraded with the internal revenue service. Ensure that the bookkeeping process abides by the legislation. Apply called for building accountancy criteria and procedures to the recording and reporting of construction task.Understand and keep conventional expense codes in the accountancy system. Interact with different funding companies (i.e. Title Business, Escrow Business) relating to the pay application procedure and demands needed for repayment. Manage lien waiver disbursement and collection - https://www.intensedebate.com/profiles/leonelcenteno. Monitor and deal with financial institution problems including charge anomalies and inspect differences. Aid with implementing and maintaining interior economic controls and treatments.

The above declarations are meant to describe the basic nature and degree of job being carried out by people appointed to this category. They are not to be taken as an extensive listing of obligations, responsibilities, and skills required. Employees may be required to execute duties outside of their typical duties once in a while, as required.

Getting The Pvm Accounting To Work

Accel is looking for a Construction Accountant for the Chicago Office. The Building Accounting professional performs a range of accounting, insurance policy conformity, and task management.

Principal tasks include, yet are not limited to, managing all accounting functions of the business in a timely and precise way and giving reports and schedules to the business's CPA Firm in the prep work of all financial statements. Guarantees that all audit treatments and functions are managed accurately. Responsible for all financial records, payroll, banking and day-to-day procedure of the audit feature.

Prepares bi-weekly test equilibrium records. Works with Project Supervisors to prepare and publish all month-to-month billings. Procedures and problems all accounts payable and subcontractor repayments. Generates monthly recaps for Employees Payment and General Liability insurance policy premiums. Generates month-to-month Task Cost to Date records and collaborating with PMs to reconcile with Task Managers' allocate each job.

Pvm Accounting - Questions

Efficiency in Sage 300 Construction and Property (previously Sage Timberline Workplace) and Procore building monitoring software a plus. https://j182rvzpbx6.typeform.com/to/qpx4zyP8. Have to also be skillful in other computer software program systems for the prep work of records, spreadsheets and other audit analysis that might be called for by management. construction taxes. Need to have strong organizational skills and capability to focus on

They are the economic custodians who make sure that building and construction tasks continue to be on budget, adhere to tax obligation laws, and keep economic openness. Building accounting professionals are not simply number crunchers; they are strategic partners in the construction process. Their main function is to handle the monetary elements of building jobs, making certain that sources are alloted successfully and economic threats are decreased.

What Does Pvm Accounting Do?

By keeping a tight hold on project funds, accountants assist prevent overspending and monetary obstacles. Budgeting is a foundation of successful building tasks, and construction accountants are critical in this regard.

Building and construction accountants are well-versed in these policies and make sure that the job abides with all tax obligation requirements. To stand out in the function of a building accounting professional, people need a solid academic structure in audit and financing.

Furthermore, certifications such as Qualified Public Accounting Professional (CPA) or Certified Construction Sector Financial Expert (CCIFP) are highly pertained to in the market. Construction tasks usually include limited target dates, altering policies, and unexpected expenditures.

See This Report about Pvm Accounting

Ans: Building and construction accountants develop and keep track of spending plans, identifying cost-saving possibilities and making sure that the project stays within spending plan. Ans: Yes, building accounting professionals take care of tax obligation conformity for construction jobs.

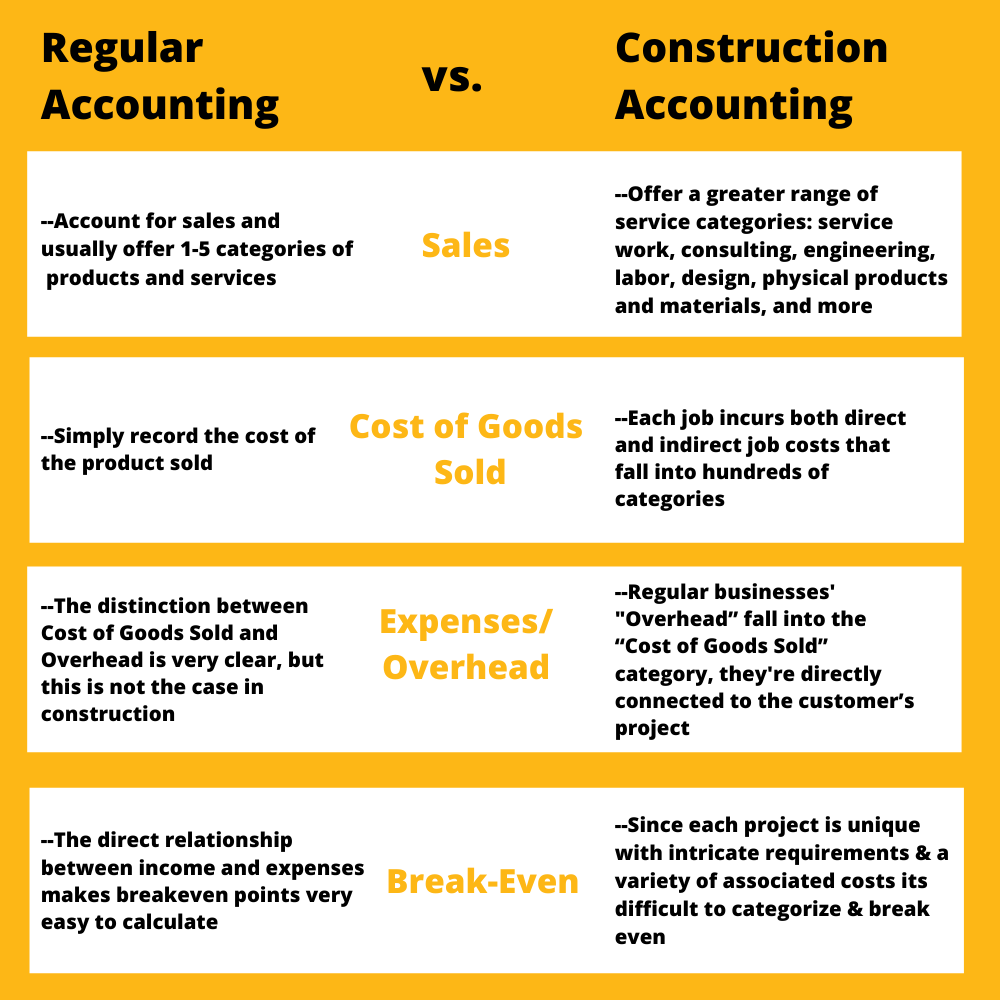

Introduction to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among several financial options, like bidding process on one task over another, choosing funding for materials or devices, or establishing a task's revenue margin. Building is a notoriously unstable market with a high failing price, slow-moving time to payment, and inconsistent cash flow.

Normal manufacturerConstruction company Process-based. Production entails repeated procedures with easily recognizable costs. Project-based. Production needs various processes, products, and equipment with varying prices. Dealt with place. Production or production occurs in a solitary (or several) regulated places. Decentralized. Each project happens in a brand-new location with varying site conditions and one-of-a-kind difficulties.

Getting The Pvm Accounting To Work

Frequent usage of various specialty professionals and providers affects efficiency and cash money circulation. Repayment arrives in complete or with regular repayments for the full agreement quantity. Some portion of settlement may be withheld till job completion also when the professional's work is finished.

Regular manufacturing and short-term agreements cause workable money flow cycles. Uneven. Retainage, sluggish payments, and high in advance costs cause long, uneven cash flow cycles - Clean-up bookkeeping. While conventional manufacturers have the benefit of regulated settings and enhanced manufacturing processes, construction business have to continuously adjust to each brand-new project. Even rather repeatable jobs require alterations because of find more information website problems and other aspects.

Report this page